The TSMC-Apple partnership has been one of the defining relationships of the mobile computing era. Without Apple as a predictable, high volume and demanding customer, it is unlikely that TSMC would have been able to catch up to Intel on advanced node semiconductor manufacturing. Similarly, without the support of the TSMC ecosystem, it is unlikely that Apple would have been able to become a pre-eminent chip design house, let alone support the massive manufacturing scale required for its products.

This post takes a closer look at how Apple helped TSMC become the leader in advanced node semiconductor manufacturing.

How TSMC Helps Apple

The first Apple designed mobile application processor chip for the iPhone to be manufactured at TSMC was the A8 which began shipping in the Fall of 2014.

Three years later, in October 2017, TSMC hosted senior executives from its most important customers and partners to mark the occasion of its 30th anniversary. One of the guests at this event was Jeff Williams, the Chief Operating Officer of Apple.

Senior executives from Apple, ASML, Broadcom, Arm, Analog Devices, Qualcomm, and NVIDIA at TSMCs 30th anniversary celebrations with founder Morris Chang, October 23, 2017

Speaking at this event, Williams highlighted the importance of the Apple-TSMC partnership and how it came to be (Link):

“It was actually 2010 that the first seeds of partnership between Apple and TSMC were planted. I had flown to Taiwan and had dinner with Morris Chang and (his wife) Sophie at their house…We were not doing business with TSMC at that time, but we had a great conversation. We talked about the possibility of doing stuff together, and we knew the possibilities were great if we could take leading-edge technology and marry it with our ambitions. It seems obvious right now, but it wasn’t then, because the risk was very substantial. The way Apple does business is we put all our energy into products, and then we launch them, and if we were to bet heavily on TSMC, there would be no backup plan. You cannot double plan the kind of volumes that we do. We want leading-edge technology, but we want it at established technology volumes. On the TSMC side, that means a huge capital investment. It means ramping faster than the more careful yield plan that the industry is used to…Together, we decided to take the bet, to take the lead and Apple decided to have 100 percent of our new iPhone and new iPad chips — application processors — sourced at TSMC. TSMC invested $9 billion and had 6,000 people working round the clock to bring up the Tainan fab in a record 11 months, and in the end, the execution was flawless. We’ve gone on to ship over half a billion chips together in that short window, and I think TSMC has invested $25 billion — $9 billion on that first venture — there are very few companies in the world that would spend $9 billion in capital across everything, let alone a single bet. So for that, we thank you, Morris Chang, and everybody at TSMC. It’s been a wonderful partnership. The big challenge we had as we looked at the mobile revolution was this tradeoff between performance and power. The view at the time was you had to choose. You had one or the other. Largely because of what the fabless model has done, what TSMC has done, what many people in this room have done, including ARM CEO Simon Segars and his organization, we came to the point where those tradeoffs are not necessary. We have performance in thoroughly constrained environments. This opens for the next decade a whole new world. In the next decade, the question is not so much ‘do we have enough processing power to meet our ambitions’. The question for us is ‘do we have the right ambitions to utilize this technology. We at Apple are not concerned about the talk of slowing in the semiconductor industry. That’s not the case at all. We think the potential is huge.”

Winning the Mobile Wave of Computing

To understand how TSMC was able to win Apple as a customer and dominate the mobile wave of computing, it is illustrative to look at how Intel came to dominate the PC wave of computing a few decades earlier.

The CPU was the primary enabling silicon platform of the PC era; and Intel, in collaboration with Microsoft established itself early on as the preeminent CPU provider for the PC industry. This lock on the global CPU supply assured Intel of massive wafer volumes; which in-turn enabled quick yield learning and defect improvement; which in turn enabled volume ramps at high margins and massive revenues. These revenues in turn funded the research and development needed for the next technology node. This virtuous cycle enabled Intel to gain, and maintain technology leadership during the PC era, and in fact was a primary driver of Intel’s success as a semiconductor manufacturer over 4 decades.

The Intel and Microsoft partnership (“Wintel”) defined the PC wave of computing. The TSMC and Apple partnership defined the mobile wave of computing.

Frequency (clock-speed) was the primary metric in the PC era and the standalone CPU was the primary chip that drove advancements in semiconductor technology for decades. Form-factor was hardly an influencer and there wasn’t as much of a drive to integrate system-level functionality either on-chip (SoC) or in-package (SiP). Form-factor, cost and power-per-function became critical drivers in the mobile market and that in turn increased the importance of on-chip integration of functional hardware (e.g., power management, computing, audio/video, graphics, GPS, and radio among others).

This shift from mostly performance-centric chips to mostly power-constrained chips and the focus on lowering cost and increasing system-level integration disrupted the traditional semiconductor landscape within just a decade and continues to reshape the industry today (I wrote about this here)

Intel’s process technology was optimized over decades to enable the highest frequency CPUs and enabled Intel to dominate the PC wave of computing. On the other hand, foundry process technology was optimized to enable a highly power efficient and cost-effective SoC technology suitable for a wide range of customers over a large dynamic operating range, long before the advent of mobile computing. The foundries, led by TSMC were thus well prepared to cater to the needs of mobile, post-PC products. Apple’s decision to use Samsung, and later TSMC as a foundry provided a significant growth catalyst for both foundries. TSMC being the largest incumbent foundry at the time was the largest beneficiary of the mobile wave of computing.

How Apple Helps TSMC

Apple was not a TSMC customer for the first several years of the iPhone and initially used Samsung to manufacture its application processors. Since 2014, TSMC has been the primary beneficiary, both as a direct supplier to Apple (including the A-, S-, W- and M- series chips) but also as an indirect supplier for other leading node and legacy node chips that go into Apple products (e.g., modems, sensors and connectivity chips from Qualcomm, Broadcom, and others). When a semiconductor foundry manufactures chips for a large, high volume, demanding customer like Apple, it wins on multiple fronts : quicker volume ramps, quicker revenue ramps, a focus on disciplined risk taking.

Quicker Volume Ramps

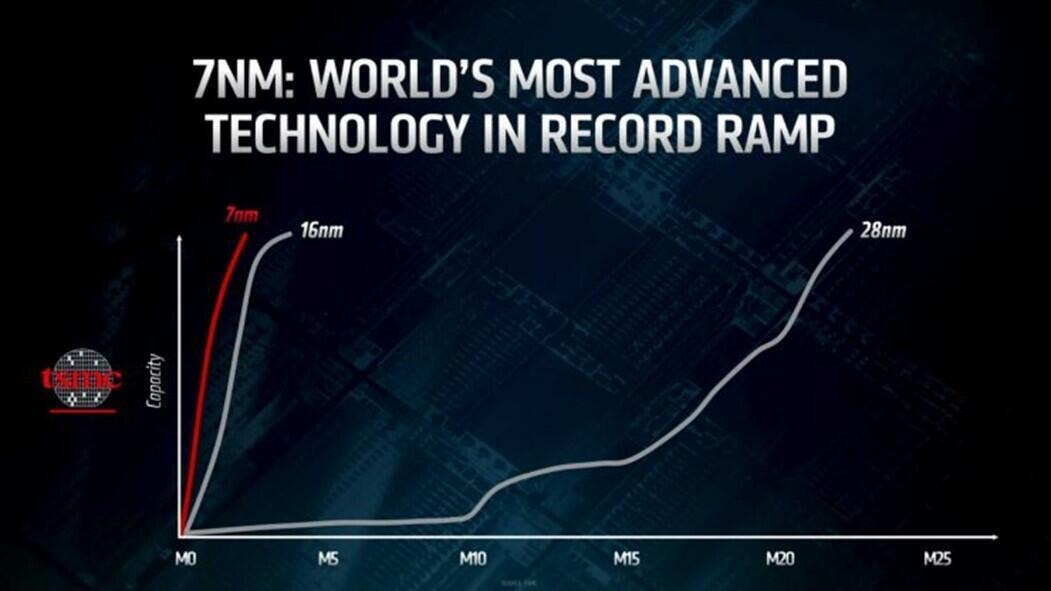

Source: AMD EPYC™ Horizon Summit – “Rome in Rome”, Sep. 18, 2019. TSMC defect density improvement rates accelerated since the 28nm node, enabling faster volume ramp rates with every successive generation.

Apple has been the lead customer on TSMCs advanced technology nodes since 2014. Massive iPhone wafer volumes and a rigid launch schedule requires TSMC to quickly debug and stabilize yields on the most complex, advanced geometry process nodes. This in turn, enables TSMC to rapidly improve manufacturability and pave the way for the second wave of advanced node customers (e.g., NVIDIA and AMD). TSMC defect density improvement rates have become much steeper over the last 4 technology nodes (Link), enabling quicker volume ramps.

Quicker Revenue Ramps

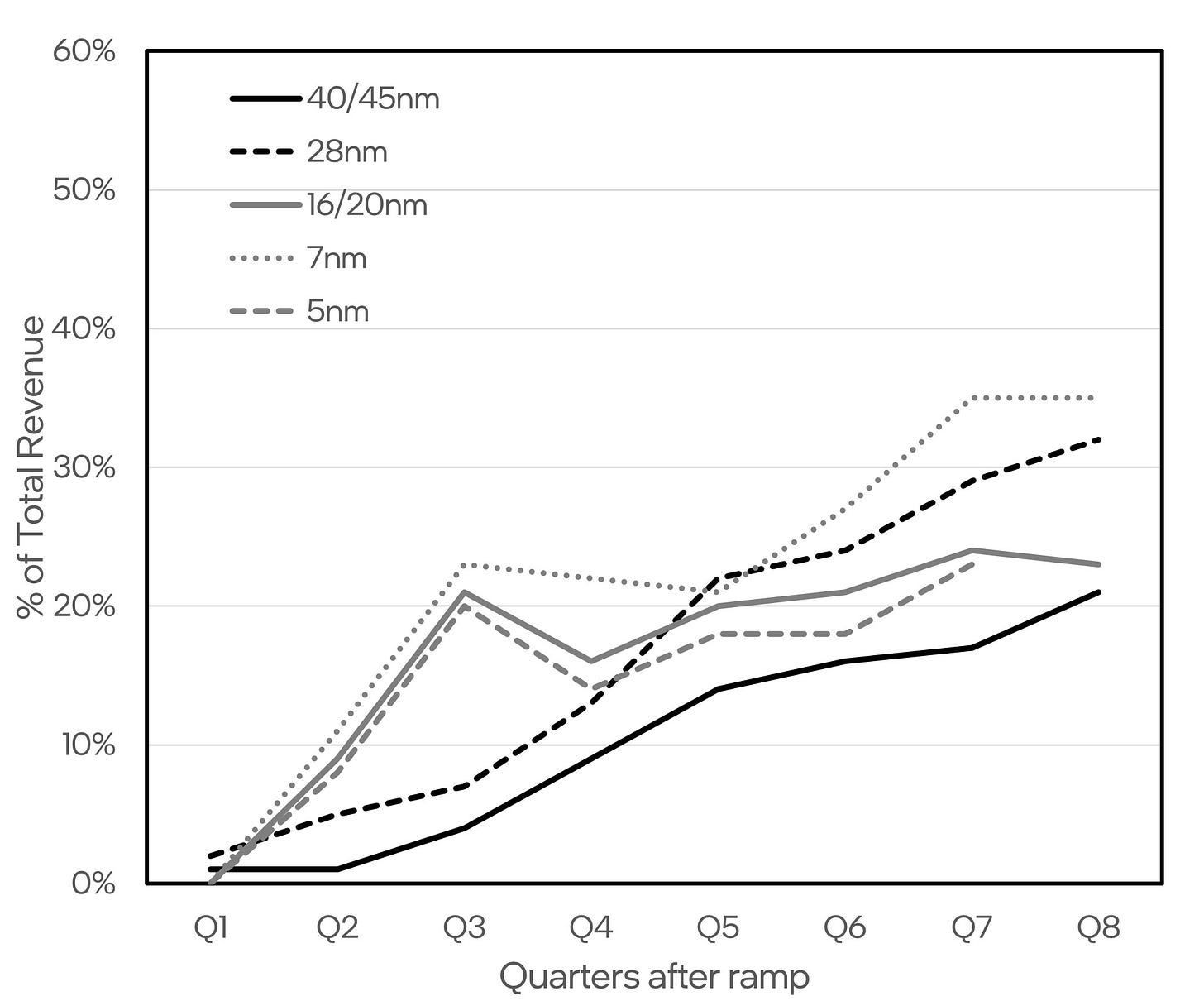

The rapid and highly predictable ramp of the iPhone every Fall dramatically accelerated TSMCs revenue run rate – TSMC now reaches 50% of peak node revenue run rate in just 2-3Q – compared to 8-9Q prior to winning the Apple iPhone design. This rapid revenue run rate shortens the node payback period and increases the return on the massive capital investment needed for the node.

TSMC earnings reports show accelerating revenue run rates for new nodes starting 28nm

Disciplined Risk Taking

Apple requires leading-edge processes for its mobile products and drives huge volumes on a predictable annual cadence. The annual iPhone cadence instilled a manufacturing discipline and served as a self-regulating mechanism for TSMC to take measured risks in its process technology choices. Prior to winning the Apple business, TSMC process nodes were introduced on an irregular, unpredictable cadence. TSMC struggled to get their 40nm (strained Si) and 28nm (HKMG) nodes to high volume and introduced multiple versions of these nodes without a strong, driving customer. Since winning the Apple iPhone SoC design in 2014, TSMC has introduced a new process node every year. This annual cadence requires TSMC to be risk-averse and make conservative process choices. Every other year, TSMC introduces a major process change (e.g., N7, N5) while in the intervening year, it refines the technology from the prior year (e.g., N7P). This alternating cadence of half-nodes and full nodes every year enables TSMC to make smaller process changes in every node, but still reap the benefits of compounded gains in the long run.

Growth Catalyst

TSMC has been a significant beneficiary of the mobile wave of computing and has seen its revenues rise steadily since the launch of the iPhone in 2007 and markedly since winning the Apple SoC design in 2014. Since 2015, Apple's revenue contribution to TSMC has been growing in both dollar and percentage terms. In 2020, Apple contributed ~$11B (25%) to TSMC total revenue. Since winning the Apple business, the increased cash flow has allowed TSMC to keep investing in its advanced node capacity. Outside of Apple, the only company that has both the capability and volume demand to be the lead adopter of a new technology node is Intel.

TSMC annual revenues increased markedly with the introduction of the iPhone (2007) and the Apple design win (2014-15) (Source : TSMC earnings reports)

Key Takeaways

Led by Apple and the iPhone, mobile computing provided TSMC with opportunities to increase wafer volumes at all nodes including legacy nodes (e.g., 40nm and older) and advanced nodes (16nm and newer). The legacy node wafer business allowed TSMC to run large volumes at full capacity and high margins on fully depreciated toolsets. The advanced node, high volume, and quick ramp products like Apple iPhone SoCs were critical in helping TSMC debug and stabilize yields on the most complex, advanced geometry process nodes, thereby quickly improving manufacturability and paving the way for the second wave of advanced node customers (e.g., NVIDIA and AMD). Without the massive volumes from Apple, it is unlikely that TSMC would have been able to catch up to Intel on advanced node semiconductor manufacturing.

The views expressed herein are my own

Good history and insight

TSMC Arizona biggest customer- Apple